Jammu, Feb 14: The Jammu and Kashmir Trade Promotion Organisation (JKTPO), in collaboration with Jammu & Kashmir Bank, organized a UT-level workshop on “Penetration of MFIs, NBFCs, and FinTech Companies for MSME Financing under RAMP” at Jammu Tawi Golf Course, Sidhra. The initiative is part of the Raising and Accelerating MSME Performance (RAMP) Programme, a World Bank-supported Central Sector Scheme aimed at enhancing MSME access to credit and markets while strengthening governance and Centre-State collaboration.

The workshop introduced financial institutions to the MSME landscape in Jammu and Kashmir and sensitized them to the challenges faced by local enterprises. It emphasized digitally empowering MSMEs through alternative funding sources and technology-driven financial solutions. Over 15 leading NBFCs, MFIs, FinTech companies, senior officials from the Industries & Commerce Department, RBI, NABARD, banking institutions, and MSME stakeholders participated.

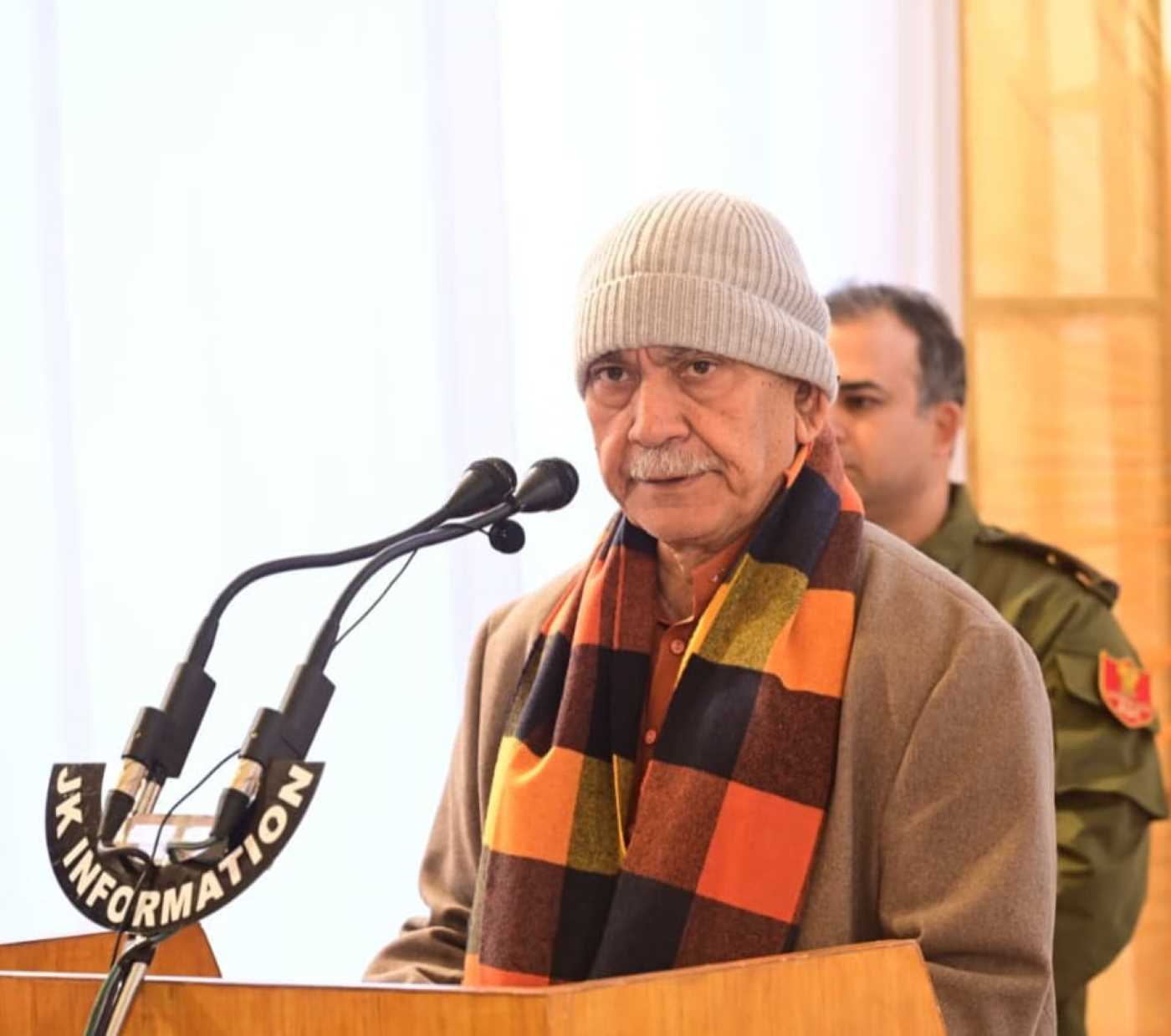

Commissioner Secretary, Industries & Commerce, Vikramjit Singh, highlighted the critical role of MSMEs in employment generation and regional economic stability. He emphasized the government’s commitment to building a resilient credit ecosystem through collaboration among banks, NBFCs, MFIs, and FinTech platforms, with district-level outreach and measurable action plans.

JKTPO Managing Director Sudershan Kumar underscored the predominance of micro enterprises in J&K and the need for flexible, doorstep-oriented credit models. RBI Regional Director Chandra Shekhar Azad stressed the importance of an inclusive financial system for sustainable MSME growth, while NABARD General Manager Vikas Mittal highlighted district-focused interventions, digital onboarding, and capacity-building initiatives.

J&K Bank Chief General Manager Sunit Kumar called for structured co-lending partnerships between banks, NBFCs, and MFIs to optimize risk-sharing, enhance last-mile outreach, and strengthen credit delivery. He reaffirmed the bank’s commitment to supporting ecosystem partnerships and district-level initiatives under RAMP.

The workshop concluded with actionable outcomes, including identification of priority sectors and districts, promotion of collaborative lending, digital enablement, awareness campaigns, and the formation of a Joint Working Group formalized through a workshop resolution.

JKTPO reaffirmed its commitment to empowering MSMEs through policy facilitation, capacity building, market linkages, and improved access to finance, marking a significant step toward a more inclusive and technology-driven MSME credit ecosystem in Jammu and Kashmir.